General Information About the Broker

AceTraders (acetraders.live) presents itself as a global online trading platform.

The broker claims to offer access to multiple financial markets.

However, the website provides very limited corporate background information.

Moreover, ownership and management details remain undisclosed.

This lack of transparency immediately raises credibility concerns.

Domain registration data suggests a recently created website.

Nevertheless, the broker implies long-term trading experience.

Such contradictions often indicate misleading marketing.

Many observers already associate risks with scam broker operations.

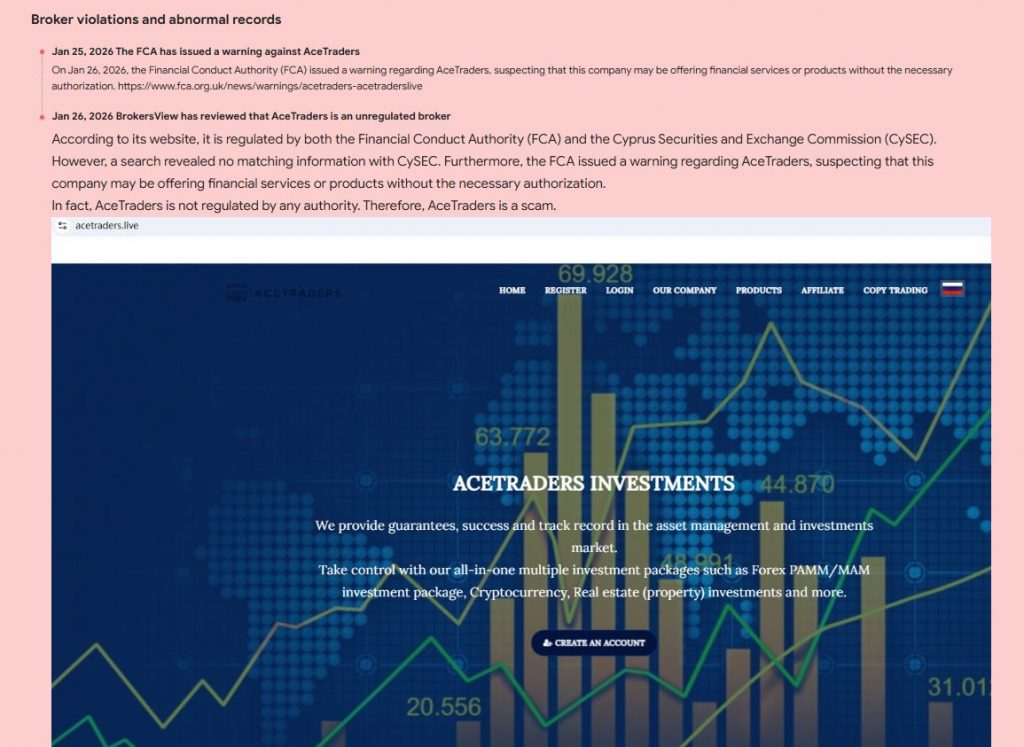

Claimed Licenses and Regulation – scam broker

AceTraders does not clearly publish regulatory authorization details.

No license numbers appear anywhere on the website.

Moreover, no supervising financial authority is mentioned.

Major international regulators do not list this broker as licensed.

Operating without regulation significantly increases investor exposure.

Unregulated brokers often use vague compliance wording.

This tactic frequently misleads inexperienced traders.

Trading Conditions

AceTraders provides unclear descriptions of account types.

Minimum deposit requirements are not transparently explained.

Moreover, spreads and commissions remain undisclosed.

Leverage information is also missing from public sections.

Such opacity prevents accurate trading cost evaluation.

Hidden conditions often cause unexpected financial losses.

This structure strongly favors the broker.

Trading Platform and Technology

AceTraders advertises a proprietary web-based trading platform.

However, platform specifications are not clearly explained.

There is no confirmation of execution quality.

Moreover, demo account availability remains unclear.

Liquidity provider information is completely absent.

These omissions reduce confidence in platform reliability.

Professional brokers usually disclose such technical details.

Client Reviews and Feedback

Feedback regarding AceTraders appears largely negative.

Several users report withdrawal delays or refusals.

Moreover, traders mention sudden account restrictions.

Aggressive calls encouraging additional deposits are frequently reported.

Customer support reportedly becomes unresponsive after funding.

These complaints form a consistent pattern.

Such experiences reinforce scam broker concerns among investors.

Potential Scam Strategies – scam broker

AceTraders may rely on high-pressure sales techniques.

Promises of quick profits attract inexperienced investors.

Moreover, unclear trading rules enable internal manipulation.

Withdrawal restrictions can trap client funds indefinitely.

Some platforms adjust prices internally.

These methods often cause rapid financial losses.

Victims usually recognize problems too late.

Expert Opinion

Experts consider AceTraders a high-risk trading platform.

The absence of regulation remains the strongest warning sign.

Moreover, hidden trading conditions significantly increase exposure.

Lack of corporate transparency further damages credibility.

Professionals strongly advise avoiding any deposits.

Overall analysis confirms serious concerns about this broker.

Conclusion

AceTraders shows numerous alarming red flags.

Unregulated operations place investors at serious risk.

Moreover, negative user feedback confirms reliability issues.

Traders should avoid engaging with this broker.

Choosing regulated platforms ensures stronger protection and transparency.