A widely followed crypto strategist says Bitcoin (BTC) just showed a setup that was witnessed only three times in the past.

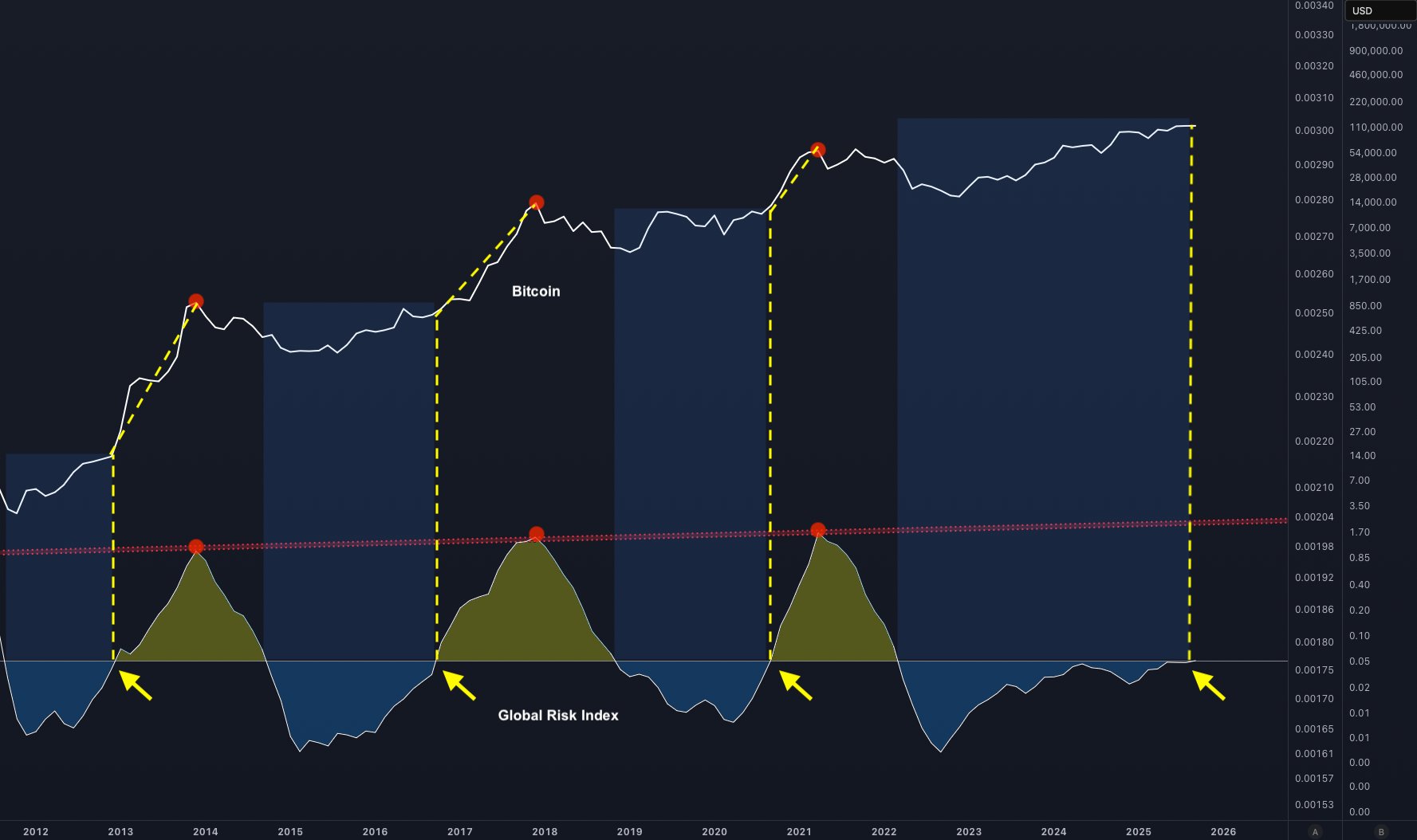

Pseudonymous analyst TechDev tells his 548,100 followers on X that he’s looking at the liquidity-adjusted business cycle metric, which is designed to analyze the interconnectedness between financial markets and the real economy.

TechDev shares a chart suggesting that Bitcoin tends to kick off the steepest rallies after the metric prints a bullish higher low setup.

“It’s…

The 2012 setup before the 2013 run.

The 2016 setup before the 2017 run.

The 2020 setup before the 2021 run.

All over again.”

The analyst also says the recovering liquidity-adjusted business cycle metric appears to align with a rising global risk index. According to TechDev, the global risk index is a ratio of three macro signals that are independent of Bitcoin and much larger than BTC. He also says that the index does not carry weights or fitting parameters.

“Potentially significant.”

Based on the trader’s chart, he seems to suggest that BTC tends to ascend after the global risk index climbs above the midpoint line.

At time of writing, BTC is worth $119,946.

As for the altcoin market, TechDev believes alts are primed to explode after breaking out from a massive bullish pattern.

“Most seem to have no idea what’s coming. Macro altcoin expansion has only just begun.”

At time of writing, TOTAL3, which tracks the total market cap of crypto excluding Bitcoin, Ethereum (ETH) and stablecoins, is trading at $1.122 trillion.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney