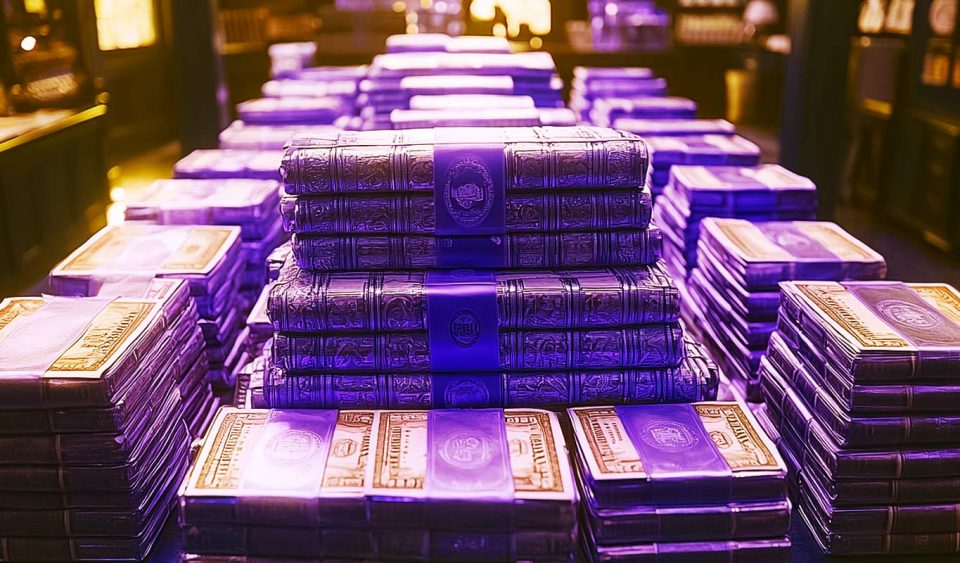

Companies and non-sovereign issuers in the Asia-Pacific region have been hawking bonds at a record rate as investors look to move away from US dollar assets, according to a new Bloomberg report.

Non-sovereign issuers are non-federal bond issuers like local and regional governments and public agencies.

Bloomberg reports that Asia-Pacific companies and non-sovereign issuers have sold $1.5 trillion in local-currency bonds year-to-date, a record in that time frame. The sales represent a 6% increase.

Daniel Tan, a portfolio manager for global emerging markets at Grasshopper Asset Management, tells Bloomberg the number of bond buyers has surged in the second quarter of the year.

“We are definitely seeing more buyers of local-currency Asian bonds than in pre-April. There are large inflows from pension and sovereign wealth funds looking to diversify away from US dollar assets.”

US President Donald Trump kicked off his wave of tariffs in April, spurring macroeconomic uncertainty.

Angus Hui, the deputy chief investment officer at the Singapore-based investment firm Fullerton Fund Management, tells Bloomberg that “diversification into broader Asian local currency markets is likely to accelerate.”

The Bloomberg Asia-Pacific Aggregate index, a multi-currency benchmark based on Asia-Pacific investment-grade bonds, has beaten the US-based bond metric, gaining 3.9% year-to-date compared to 3.5%, respectively.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney