AuroraTradesP (auroratradesp.com) presents itself as a multi‑asset broker. It advertises trading in forex, cryptocurrencies, commodities, and indices. The site claims strong technology, fast execution, and modern services. However, many essential company details are vague or missing. The actual operation track record is not clearly documented. Such gaps already raise doubts about its legitimacy and stability.

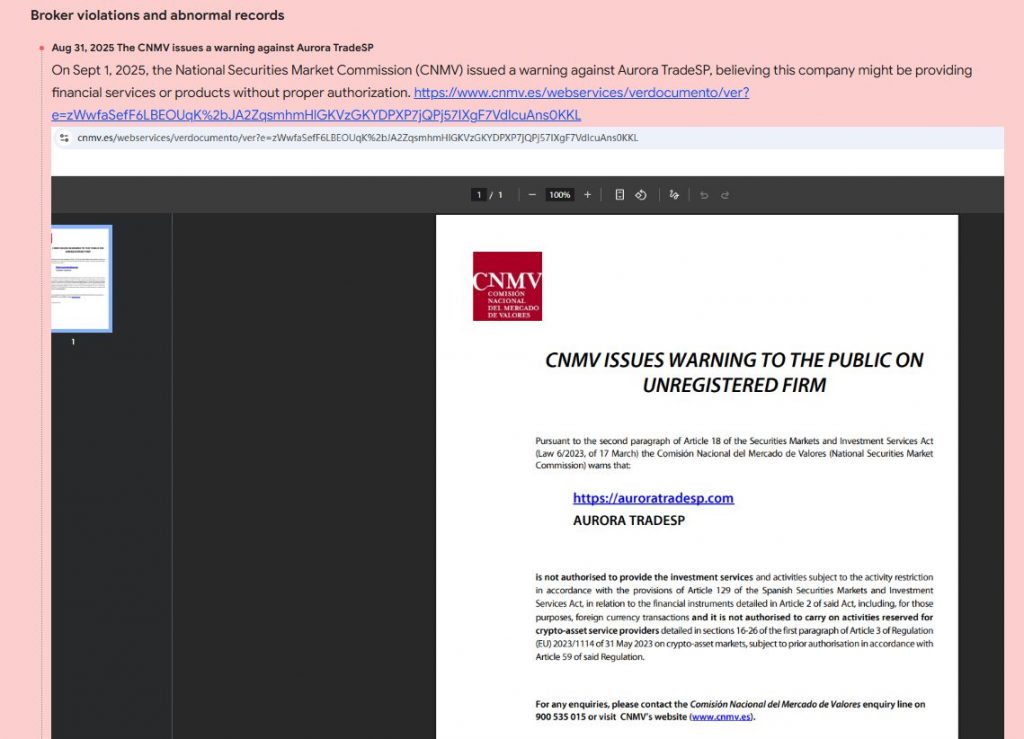

Claimed Licenses and Regulation

AuroraTradesP does not clearly show valid licensing. It makes no mention of known regulators like FCA, CySEC, or ASIC. The absence of a formal regulatory statement is alarming. Without clear oversight, it remains unclear how this broker is monitored. Such missing transparency suggests high risk for traders.

Trading Conditions

The broker advertises competitive trading terms and features. Nevertheless, it hides key data on minimum deposit and fees. No public breakdown of account types is available. There is no clear fee or commission structure revealed. Clients are left in the dark about actual trading costs. This lack of clarity often signals hidden charges or traps.

Trading Platform and Technology

AuroraTradesP offers a web trading interface for clients. However, it does not disclose which platform is used.

No MetaTrader, cTrader, or mobile app is clearly listed. There are no demos or screenshots to assess platform quality. The vague platform claims prevent users from testing reliability.

Client Reviews and Feedback

Some reports link “AuroraStocks” as a clone impersonating broker names. Regulators warn that aurorastocks.com clones real firms. Clients claim deposit, withdrawal, and support issues under that alias. Reddit stories mention users losing thousands via these platforms. Such feedback connects to practices similar to those by AuroraTradesP.

They suggest serious trust and security problems for investors.

Potential Scam Strategies

AuroraTradesP may use common manipulation tactics:

- Attracting users with promises of high returns or low risk.

- Allowing small withdrawals but blocking larger ones.

- Changing trading conditions after deposit is accepted.

- Using clone names or identities to confuse regulators.

These strategies aim to trap client funds behind vague terms.

Expert Opinion

AuroraTradesP raises multiple red flags in my analysis. It lacks proof of regulation and hides crucial details. Its trading cost structure and platform claims are opaque. Mangling with clone names and aliases further deepens suspicion. Combined with negative user reports, this broker seems risky. I consider it unreliable and possibly fraudulent.

Conclusion

AuroraTradesP fails tests of transparency, regulation, and trust. Users cannot verify licensing, cost structure, or platform integrity. I strongly advise against investing with AuroraTradesP. Instead, pick a broker with clear regulation and full disclosure.