BlueOakCapital Broker Review – General Information About the Broker

BlueOakCapital presents itself as an online trading and investment platform.

The broker claims to offer services for traders worldwide.

It promotes access to forex, cryptocurrencies, indices, and commodities.

However, company background information remains very limited.

Ownership details are not clearly disclosed on the website.

Moreover, corporate registration data is not openly provided.

The platform relies heavily on promotional descriptions.

Such an approach often raises transparency concerns.

This BlueOakCapital broker review highlights these early warning signs.

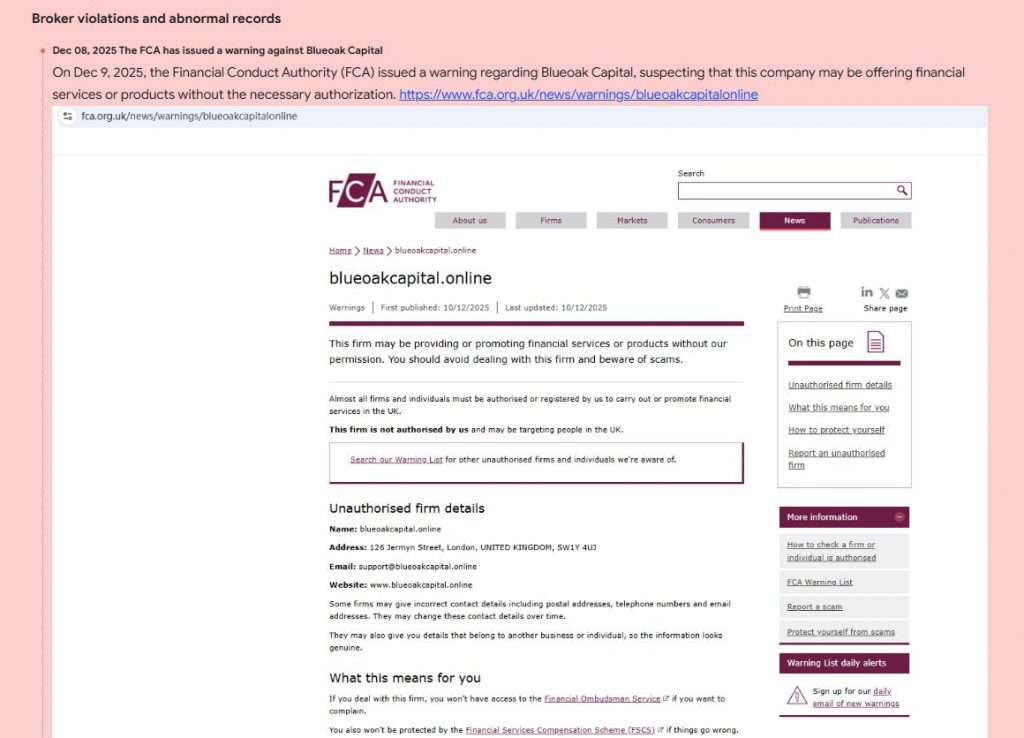

Claimed Regulation and Legal Status

BlueOakCapital claims to operate under international financial standards.

However, it does not name any recognized financial regulator.

License numbers are not displayed for verification.

Moreover, regulatory status cannot be independently confirmed.

Unregulated brokers operate without strict oversight.

Client funds may not receive proper legal protection.

This lack of supervision significantly increases financial risk.

Trading Conditions and Account Information

BlueOakCapital advertises several account types for different traders.

However, account conditions remain poorly explained.

Minimum deposit requirements are not clearly stated.

Spreads are not transparently disclosed.

Commission structures are also missing.

Moreover, leverage limits are vaguely described.

Such omissions prevent accurate risk evaluation.

Clear conditions are essential for informed trading decisions.

Trading Platform and Technical Features

The broker promotes a modern online trading platform.

However, platform specifications remain unclear.

There is no confirmation of support for established trading software.

Web-based platforms may limit advanced trading tools.

Moreover, execution quality cannot be independently verified.

Technical transparency appears insufficient for professional traders.

BlueOakCapital Broker Review – Client Reviews and Feedback

Online feedback reveals recurring client dissatisfaction.

Several users report difficulties withdrawing funds.

Others mention delayed responses from customer support.

Moreover, traders describe pressure to deposit additional money.

Account managers allegedly use aggressive communication tactics.

These patterns often indicate operational problems.

This BlueOakCapital broker review reflects consistent negative user experiences.

Potential Scam Indicators

Some brokers rely on unrealistic profit promises.

BlueOakCapital marketing language may appear overly optimistic.

Hidden fees can gradually reduce account balances.

Moreover, withdrawal rules may change without notice.

Such practices often harm inexperienced traders.

Lack of regulation increases misuse potential.

Expert Opinion

BlueOakCapital shows several warning signs.

Regulatory uncertainty remains the primary concern.

Transparency across key areas is insufficient.

Trading conditions lack proper disclosure.

User complaints further weaken overall trust.

Cautious traders should avoid unnecessary exposure.

Conclusion

BlueOakCapital raises serious reliability concerns.

Key company information remains undisclosed.

Unclear regulation increases potential financial losses.

User feedback suggests repeated operational issues.

This BlueOakCapital broker review emphasizes significant trading risks.

Choosing regulated brokers offers stronger investor protection.