Real Vision’s chief digital assets analyst Jamie Coutts says that a bottom may be forming in the crypto market after declining for weeks.

Coutts tells his 33,800 followers on the social media platform X that based on a metric tracking the performance of crypto assets over 365 days the market is gearing up for a bullish reversal.

“This month’s crypto flush resulted in the highest 365-day new low (NL) reading since mid-2024. While not a definitive bottom signal, it suggests a bottom is forming. Focus on assets that outperformed over the past year and during this recent pullback. Their strength hints at what’s to come in the next leg of this cyclical bull market.”

He also shares the TOTAL2 chart – the market cap of all crypto assets excluding Bitcoin (BTC) and stablecoins – which shows a possible reversal forming on the daily timeframe after a downtrend.

TOTAL2 is valued at $1.24 trillion at time of writing.

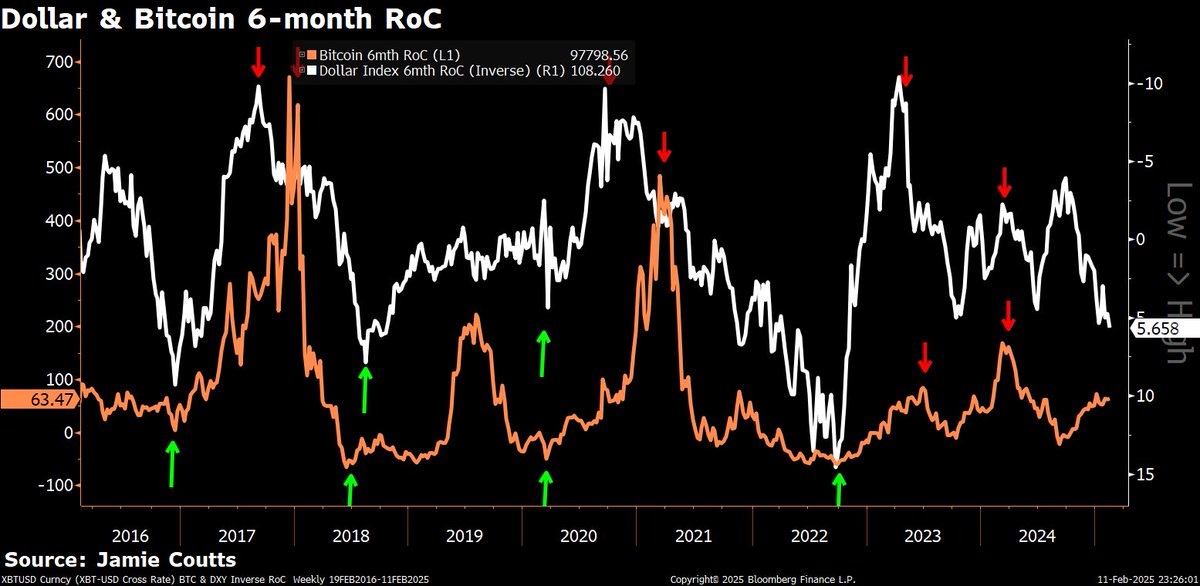

Next up, Coutts says Bitcoin may be breaking its historic inverse correlation with the US dollar index (DXY), which pits the USD against a basket of other major foreign currencies, as more investors may be treating the flagship crypto asset as a safe-haven asset similar to gold.

“Bitcoin’s inverse correlation with the dollar broken? Since the September low, BTC surged from $70,000 to $110,000 while the DXY climbed from 104 to 110. Is it ETFs (exchange-traded funds), MSTR (MicroStrategy), sovereigns? Hard to say. Maybe Bitcoin is finally being recognized as the safe harbor asset it was destined to be.”

He also says that the adoption of blockchain technology is surging based on the metric of daily active addresses (DAAs) on smart contract platforms (SCPs).

“Liquidity drives on-chain activity – always has. But since 2022, that relationship has weakened. Blockchain adoption is proving more resilient and less tethered to liquidity cycles. Over the past year, active addresses have tripled while markets remain their usual schizophrenic selves, debating where liquidity is headed next. But here’s the thing: the tech is hitting escape velocity. Zoom out. Both liquidity and blockchain usage are in long-term uptrends. The only question that matters – will they be higher in one, three or five years.”

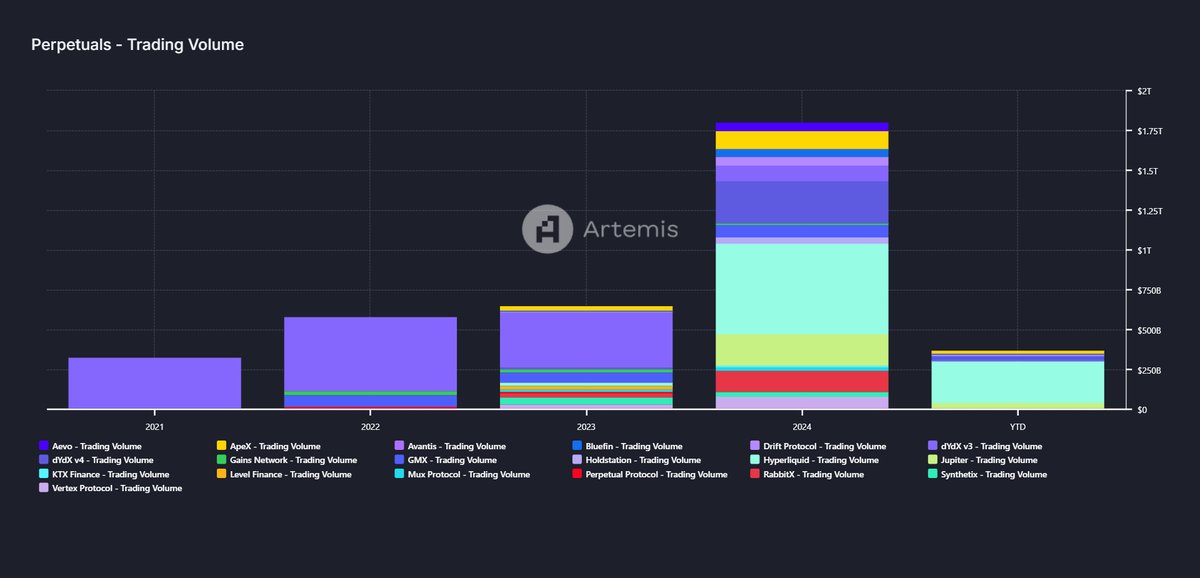

Lastly, he predicts that 2025 will see an explosion of blockchain technology adoption across several sectors.

“In 2025, we will likely see on-chain perps volumes exceeding $4 trillion. What until RWAs (real-world assets) land en masse, stocks, commodities, bonds, and KYC (Know Your Customer) solutions so institutions can participate. Which chains and protocols do you think will benefit most from what is about to happen?”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney