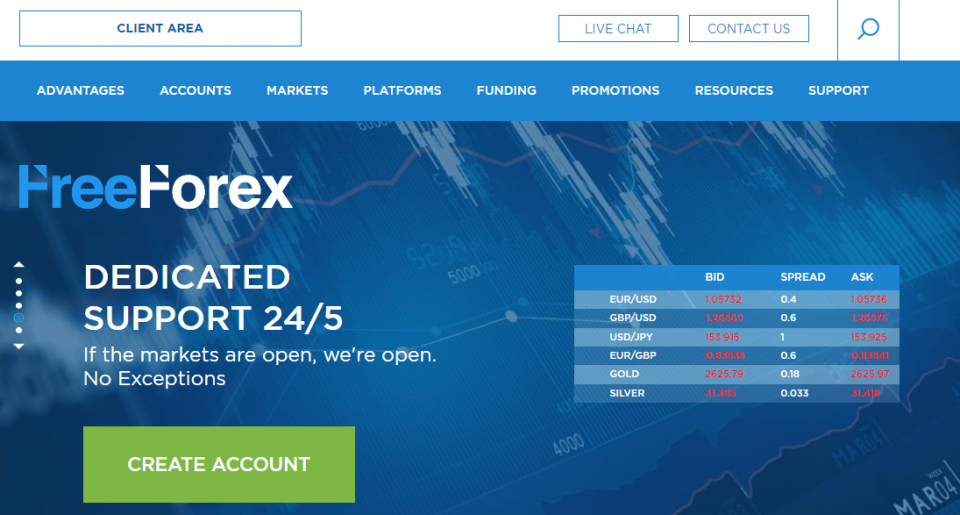

FreeFX (freefx.com) advertises itself as a versatile online trading platform. It claims to offer access to major financial markets, including forex, commodities, stocks, and cryptocurrencies. While the broker promises advanced tools and competitive conditions, deeper analysis reveals several alarming red flags.

Regulation: Is FreeFX Legitimate?

The regulatory status of a broker is crucial for investor safety. However, FreeFX provides no evidence of being regulated by any recognized authority.

For example, it is not registered under the FCA, ASIC, or any other respected financial watchdog. Furthermore, the absence of regulation means client funds are unprotected. This increases the risk of fraud or malpractice.

Trading Conditions: Are They Transparent?

FreeFX offers multiple account types, with a minimum deposit starting at $250. It also advertises high leverage and low spreads. However, important details like fees, commissions, and additional charges are missing.

This lack of transparency can lead to unexpected costs. Furthermore, high leverage poses significant risks, especially for inexperienced traders. Without clear risk warnings, traders may incur substantial losses.

Trading Platform: A Lack of Information

FreeFX claims to use a proprietary web-based trading platform. However, the broker does not provide detailed information about its features or security measures.

Moreover, there is no demo account option. This prevents potential clients from testing the platform before depositing funds. Additionally, the absence of visible security protocols raises concerns about the safety of client data.

What Do Clients Say?

Client feedback about FreeFX is overwhelmingly negative. The most common complaints include:

- Withdrawal Problems: Many clients report difficulties accessing their funds. In some cases, requests are ignored or denied.

- Unresponsive Support: Traders struggle to get assistance with their issues. Emails and calls often go unanswered.

- High-Pressure Sales: Some clients describe aggressive tactics to push them into depositing more money.

These complaints align with behaviors often seen in fraudulent brokers.

Potential Signs of a Scam

Several red flags suggest FreeFX may operate as a scam:

- Unrealistic Returns: Promises of high profits with minimal risks are typical of scams.

- Opaque Costs: A lack of fee transparency leaves traders vulnerable to hidden charges.

- Withdrawal Issues: Many users face unnecessary hurdles when attempting to withdraw their money.

- Pressure Tactics: Clients report being coerced into making larger deposits.

Expert Opinion on FreeFX

FreeFX’s lack of regulation and transparency are major concerns. Combined with numerous negative client reviews, it seems likely that the broker engages in unethical practices. Investors should avoid this platform and choose brokers that are regulated by trusted financial authorities.

Conclusion: Avoid FreeFX

FreeFX (freefx.com) displays multiple warning signs of a fraudulent broker. Its unregulated status, unclear terms, and poor client feedback make it highly risky. For a safer trading experience, select a broker with a proven reputation and proper regulation.