This article provides a detailed Forexpediaa review of the firm operating via forexpediaa.com. The company presents itself as a comprehensive provider of forex signals, copy trading services, and portfolio management. It claims global reach, advanced analytics, and round‑the‑clock support. However, the available information raises several concerns about transparency and credibility. In this Forexpediaa review we examine the essential facts, inconsistencies, and risk indicators.

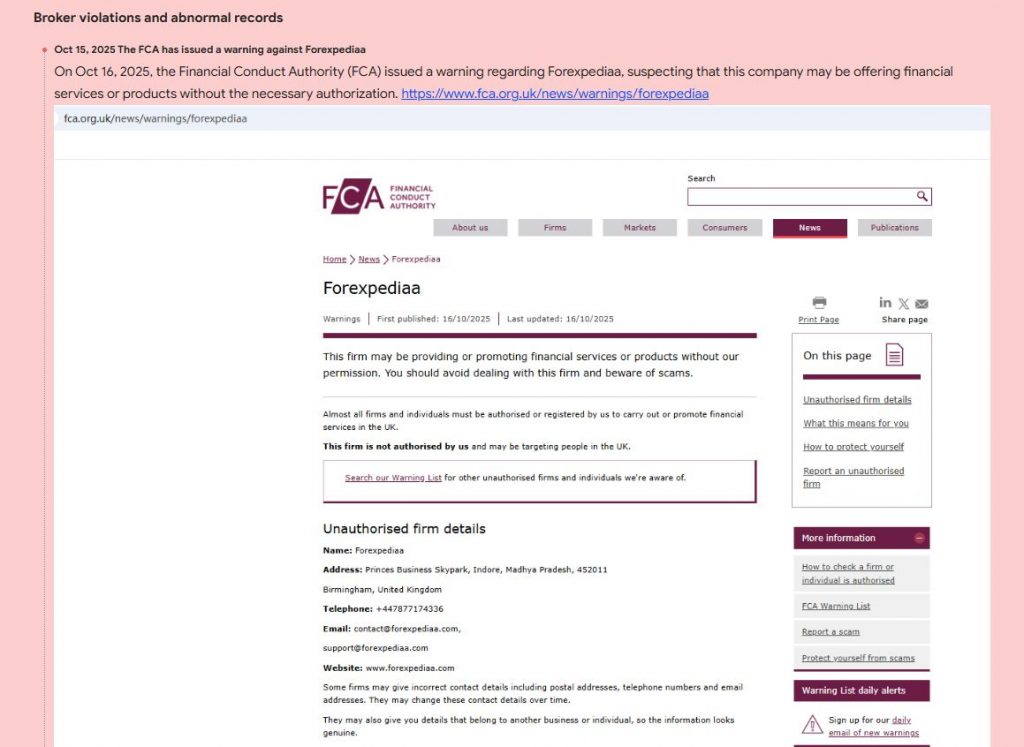

Claimed Licenses and Regulation

In this Forexpediaa review we investigate the regulatory status. The website asserts that it operates under proper oversight, yet independent sources show no verification of recognised licences from major financial authorities. One risk‑analysis service labels the platform’s trust score as “somewhat low” due to young domain age and hosting with multiple suspicious sites. The absence of clear licence credentials and formal regulatory supervision significantly increases risk for clients.

Trading Conditions

The trading conditions mentioned in this Forexpediaa review appear enticing but lack clarity and specificity. The company advertises “accurate signals” and “expert account management” yet it does not transparently publish typical spreads, commission tiers, or detailed leverage policies. Without detailed information, traders cannot assess cost structures or risk exposures. Marketing highlights lofty profit targets and high signal accuracy rates, which often correspond to elevated risk in practice.

Trading Platform and Technology

In this Forexpediaa review we consider platform and technology claims. The firm states it supports copy‑trading and live portfolio management through mobile and desktop access. Nonetheless, it does not disclose which trading software is used (such as MT4 or MT5), execution speed metrics, or liquidity provider identities. The general lack of platform‑specific proof and user testimonials diminishes confidence in the operational robustness of the service.

Client Reviews and Feedback

Feedback gathered in this Forexpediaa review presents a mixed picture. Some users praise signal accuracy and responsive service, while others report major losses and withdrawal issues. For instance, one user claimed a loss of around $10,000 during a managed account stage and alleged severe risk management problems. Conversely, promotional testimonials on the website highlight consistent profitability. This disparity between marketing and user‑reported experience warrants caution.

Potential Scam Strategies

Based on the findings in this Forexpediaa review, possible scam tactics include:

- Promoting high‑accuracy signals and guaranteed returns to attract deposits.

- Operating without verifiable regulation or licence, reducing client protections.

- Withholding clear cost and execution information, so clients cannot assess risk.

- Making withdrawals difficult or conditional while encouraging more deposits.

Investors engaging under these conditions may face substantial losses with minimal recourse.

Expert Opinion

In this Forexpediaa review our expert assessment is that the firm carries a high‑risk profile and lacks reliable safeguards. The most critical concerns are missing robust regulation, vague trading conditions, and conflicting user feedback. A reputable broker discloses full licence details, transparent fees, and verified user reviews. Forexpediaa does not consistently meet these standards and should therefore be regarded with extreme caution.

Conclusion

This Forexpediaa review highlights multiple red flags and strongly recommends avoiding this provider. If you value regulatory security, transparent trading terms, and proven reliability, select a well‑established, regulated brokerage instead. In short: do not deposit funds with forexpediaa.com.