This article provides a thorough FairMarketsPro review of the broker operating via fairmarketspro.com. The broker presents itself as a financial services provider offering online trading and investment solutions. On the website the company claims broad global access and quick returns, yet offers very limited verifiable information about its founding or business history. In this FairMarketsPro review we highlight discrepancies between marketing claims and available transparency.

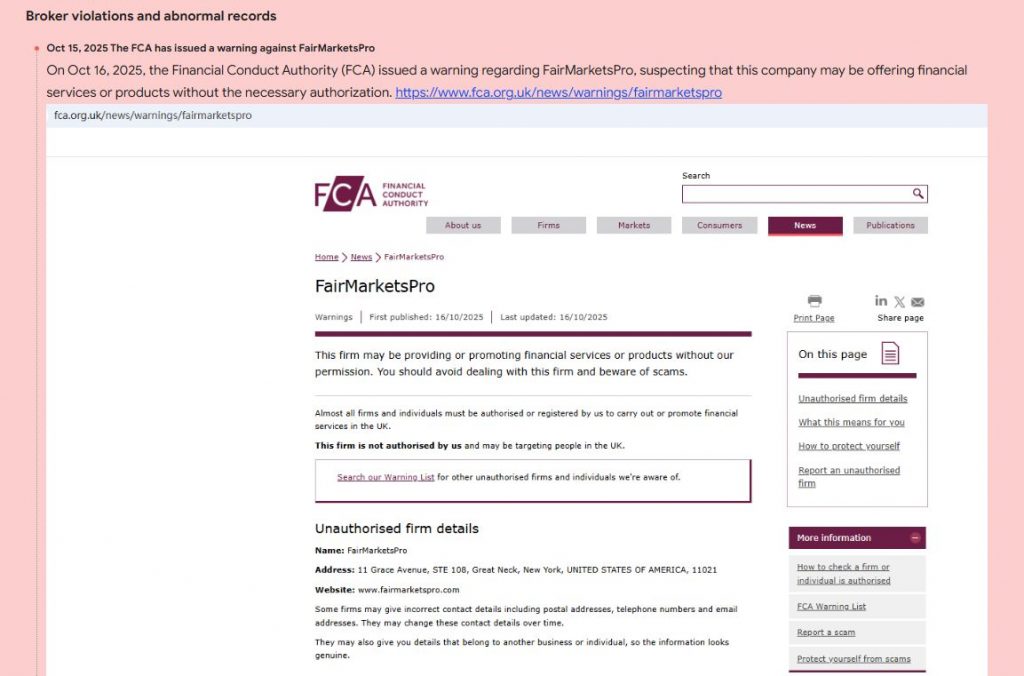

Claimed Licenses and Regulation

In this FairMarketsPro review we focus on regulation. The broker’s website presents an address in the United States and suggests global reach. However, independent investigations show no valid licence from major financial regulators such as the Financial Conduct Authority (FCA) or equivalent. One safety‑review source reports that the broker “lacks registration with any respected financial authority.” This absence of oversight is a major red flag. Without proper regulation, client protections are likely weak or non‑existent.

Trading Conditions

The trading conditions described in this FairMarketsPro review appear vague and inconsistent. The website claims a wide range of instruments but fails to clearly publish key details such as minimum deposit levels, typical spreads or commission structures. Such omission makes it impossible to assess true cost and risk. Moreover, the broker uses promotional language promising superior returns and easy profits, which signals unrealistic expectations. This kind of marketing is often used by high‑risk or fraudulent operations.

Trading Platform and Technology

In this FairMarketsPro review we examine platform and technology claims. While the broker references a proprietary trading platform, it offers no credible demonstration, user screenshots or independent reviews of technology performance. The lack of transparency around execution speed, market data sources and liquidity providers is concerning. If the broker delays demo or live access until deposit, that is another warning sign.

Client Reviews and Feedback

Feedback gathered in this FairMarketsPro review is largely negative. Several reports claim difficulties withdrawing funds or unexplained account restrictions. One source states that the broker “seems to function outside of any formal regulatory framework.” Without testimonies of smooth, verifiable trading and withdrawal experiences, credibility remains low. The absence of well‑documented positive feedback adds to suspicion.

Potential Scam Strategies

Based on information in this FairMarketsPro review, several likely scam tactics emerge:

- Promising large profits or guaranteed returns to lure deposits.

- Operating without genuine licence so that fund segregation and protection are absent.

- Withholding realistic trading cost details to conceal poor terms.

- Creating obstacles to withdrawal or requiring extra payments to release funds.

These tactics can lead to serious financial losses, with little recourse for clients.

Expert Opinion

In this FairMarketsPro review our conclusion is that the broker exhibits numerous risk factors and cannot be regarded as reliable. The key concerns include the missing regulation, opaque cost architecture, and high‑pressure marketing. Legitimate brokers offer verifiable licences, transparent terms and published user feedback. FairMarketsPro fails to provide these. The combination of missing oversight and unclear trading conditions significantly raises the risk of engaging with this broker.

Conclusion

This FairMarketsPro review highlights multiple red flags and recommends avoiding this broker. If you value investor protection, transparent trading conditions and regulatory oversight, you are better served by established, regulated brokers with a proven track record. In short: do not place funds with fairmarketspro.com.