This article brings a detailed BlockBridge Exchange review of the broker operating via blockbridgeexchange.com. The broker positions itself as a high‑performance trading platform offering CFDs across forex, equities, commodities and futures. Its website features “copy trading”, “hundreds of strategies” and “deep liquidity”. However, the presentation raises notable questions. In this BlockBridge Exchange review we dissect critical details and assess risks.

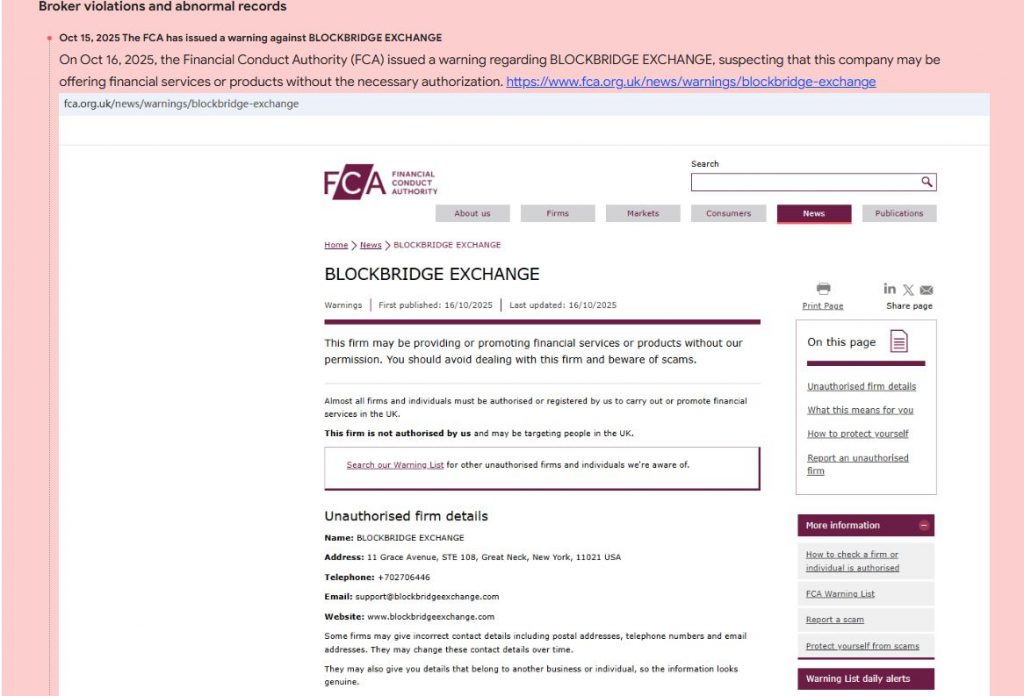

Claimed Licenses and Regulation

In this BlockBridge Exchange review we examine licensing claims. According to public reports, the broker presents no verifiable licence from major regulators and appears to operate unregulated. A regulatory‑alert site flags the company as lacking valid oversight. This absence of transparent regulation is a serious warning sign for any trader.

Trading Conditions

The trading conditions highlighted in this BlockBridge Exchange review appear attractive yet vague. The website mentions “tight spreads”, access to global markets 24/7, and multiple plans with high minimums. For example it lists a “Stock Silver Plan” with a minimum deposit of USD 25,000. There is no clear disclosure of typical spread ranges, commissions or detailed leverage limits. Such missing information reduces clarity and increases risk for clients.

Trading Platform and Technology

In this BlockBridge Exchange review we explore platform and technology claims. The broker advertises an integrated platform that allows manual, automated and copy trading. But it does not provide independent proof of software performance or execution quality. Moreover, details about the actual trading interface, liquidity providers and order routing are absent. That lack of technical transparency should concern potential users.

Client Reviews and Feedback

Feedback gathered in this BlockBridge Exchange review shows a mix of promotional testimonials and external warnings. The broker’s website includes glowing quotes from traders claiming large profits and quick withdrawals. Contrastingly, independent review sites caution that the broker is unregulated and may not be trustworthy. The conflicting evidence of user experience means the overall credibility remains doubtful.

Potential Scam Strategies

Based on the information in this BlockBridge Exchange review, potential scam tactics include:

- Promises of high returns or “professional charts” to attract high deposits.

- Operating without proper regulatory oversight, leaving clients unprotected.

- Lack of transparent cost and risk terms, making it hard to assess true trading conditions.

- Using testimonials and big‑deposit plans to push clients into risky positions.

Such strategies can result in serious financial losses and limited recourse for clients.

Expert Opinion

In this BlockBridge Exchange review our conclusion is that this broker presents elevated risk. The primary issues are lack of regulatory verification, unclear trading terms and minimal transparency around platform performance. Realistic brokers disclose licencing details, publish clear fee and trading information, and have verifiable user feedback. BlockBridge Exchange fails these benchmarks and should therefore be approached with extreme caution.

Conclusion

This BlockBridge Exchange review highlights multiple red flags and recommends avoiding this broker. If you value regulatory safety, transparent trading conditions and proven reliability, choose a well‑established regulated firm. In short: it is wise not to deposit funds with blockbridgeexchange.com.