This article offers a clear XeusFinance review of the broker operating via xeusfinance.com. The broker claims to provide online trading services in forex, commodities and cryptocurrencies. The website mentions “elite account levels” and “personal account manager” features. Yet the lack of public documentation and independent validation raises concern. We analyze the operation, claims and transparency issues of XeusFinance in this review.

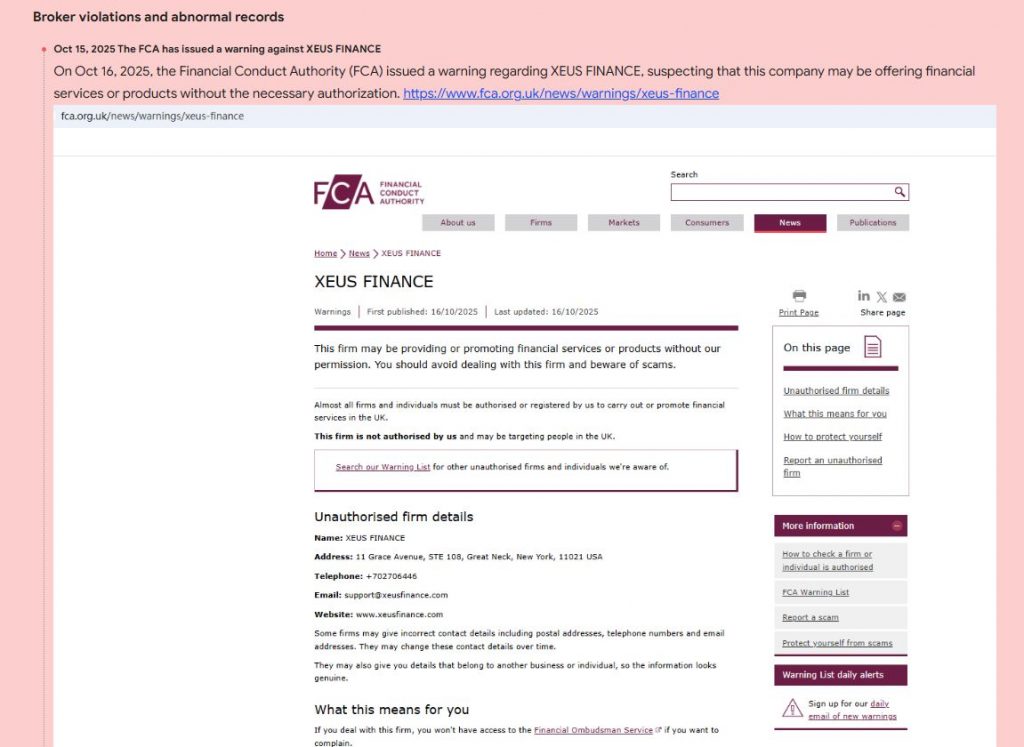

Claimed Licenses and Regulation

In this XeusFinance review we look at regulation. The broker claims to be regulated in a foreign jurisdiction but provides no clear licence number or regulatory authority details. Reports indicate the firm may not be registered with major recognised regulators. That lack of oversight significantly increases risk for clients. Without proper regulation, client funds and rights may lack protection or recourse mechanisms.

Trading Conditions

The trading conditions outlined in this XeusFinance review appear attractive but incomplete. The broker lists account tiers with varying benefits and minimum deposits. However, it fails to clearly publish typical spreads, leverage limits or commission structures. The missing disclosure of real cost metrics undercuts transparency. Furthermore, promotional language promises high returns with minimal risk, which is often unrealistic and should trigger caution.

Trading Platform and Technology

In this XeusFinance review we examine platform and technology. The broker claims a proprietary trading environment with mobile and desktop access. Yet it does not specify which trading engine, execution infrastructure or liquidity sources it uses. There are no publicly available user reviews of the platform’s performance. The absence of technical detail means potential clients cannot assess reliability or execution quality.

Client Reviews and Feedback

Feedback gathered in this XeusFinance review is largely critical or cautionary. Some users report difficulties withdrawing funds or unclear conditions tied to promotions. Others indicate that “account manager” pressures increased deposits rather than supported trading. The absence of strong positive testimonials combined with warning‑lists mentions suggests elevated concern. The broker’s reputation appears weak on verifiable client trust.

Potential Scam Strategies

Based on our XeusFinance review, likely scam tactics include:

- Promising high returns or “elite accounts” to attract large deposits.

- Operating without transparent or verifiable regulatory oversight.

- Providing vague terms and then restricting or delaying withdrawals.

- Using personal account managers to push upgrades and additional funds.

These tactics often lead to loss of funds and limited ability to reclaim them.

Expert Opinion

In this XeusFinance review our expert assessment is that this broker presents a high‑risk profile. Key issues are missing regulation, opaque trading conditions and unverified platform claims. A credible broker would publish licence credentials, clear fee structures and independent user feedback. XeusFinance does not manifest those standards and therefore should not be trusted with significant funds.

Conclusion

This XeusFinance review highlights multiple red flags and strongly recommends avoiding this broker. If you value investor protection, transparent trading conditions and regulatory oversight, you are better off choosing a well‑established regulated firm. In short: do not deposit funds with xeusfinance.com.