General Information About the Broker

HashXCapital promotes itself as a modern trading platform.

The broker claims strong expertise and reliable market access.

However, basic domain checks reveal several concerning details.

The domain appears recently registered with no proven history.

This fact contradicts claims about long experience in trading services.

Such inconsistencies often signal unreliable business practices.

The website also provides vague descriptions of its operations.

This lack of transparency should worry potential clients.

Claimed Licenses and Regulation

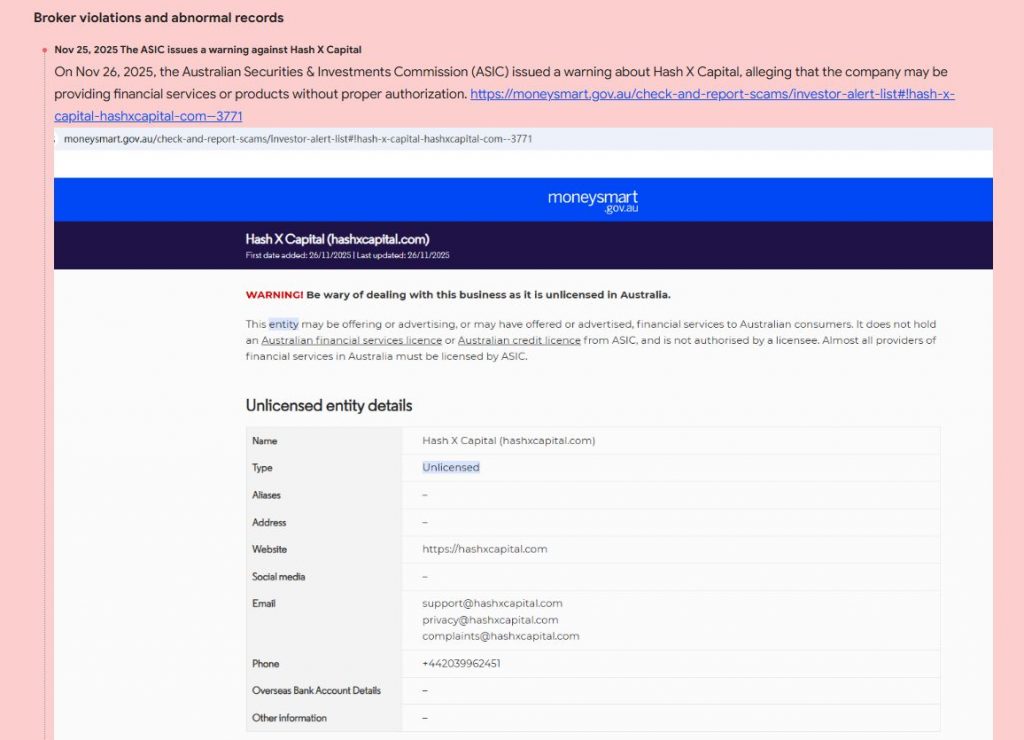

HashXCapital states that it works under strict regulation.

However, the broker does not appear in official regulator databases.

There is no record in FCA, ASIC, or CySEC listings.

Licensed brokers must follow strict rules and protect client funds.

Unregulated brokers operate without oversight and often ignore safety standards.

This absence of verified regulation is a serious warning sign.

Trading Conditions

The broker advertises competitive spreads and fast execution.

However, crucial details remain hidden across the website.

Spreads, commissions, and real trading costs are unclear.

The broker also mentions high leverage levels that exceed safe limits.

Such offers can attract beginners with unrealistic expectations.

Hidden fees often lead to unexpected and significant losses.

This lack of clarity resembles tactics used in many scams.

Trading Platform and Technology

HashXCapital claims to offer advanced trading tools.

However, users must register before viewing real platform features.

This approach hides essential information from potential clients.

There is no mention of trusted software like MetaTrader.

Unknown platforms can manipulate price feeds or delay execution.

These risks place traders in vulnerable positions.

Safe brokers provide platform access before registration.

Client Reviews and Feedback

Many online reviews describe troubling experiences with the broker.

Users report long delays when requesting withdrawals.

Some clients mention blocked accounts after gaining profits.

Others describe strong pressure to deposit more funds.

Support often becomes unresponsive during payout requests.

These patterns resemble common fraudulent broker behavior.

Potential Scam Strategies

HashXCapital displays several known scam indicators.

The broker hides trading conditions to confuse inexperienced traders.

It promises quick profits without real transparency or data.

Withdrawal issues appear once users try to access their money.

Unregulated brokers often use similar tactics to deceive clients.

Traders must stay cautious when seeing these warning signs.

Expert Opinion

HashXCapital raises many red flags.

The broker lacks valid regulation and transparent service details.

Its domain age contradicts claims of long experience.

Client complaints highlight serious problems with withdrawals.

The unclear platform also suggests possible manipulation.

These factors create strong doubts about the broker’s reliability.

Conclusion

HashXCapital presents significant risks for traders.

The broker operates without regulation or transparent conditions.

Client feedback shows repeated issues with access to funds.

Its unclear platform and hidden fees increase danger.

Traders should avoid this broker completely.

Safer options include well-regulated brokers with proven reputations.