JDFX (jdfx.co.nz) claims to offer forex, CFD, metals, and indices trading. They state they use the MetaTrader 4 (MT4) platform. The website says it was founded in 2012 by JD Capital Financial Group Ltd. It marks its address in Auckland, New Zealand. The site asserts global reach and professional services. However, many operational and verification details are missing. The public company history and transparency seem weak. Such vagueness raises concern about its true reliability.

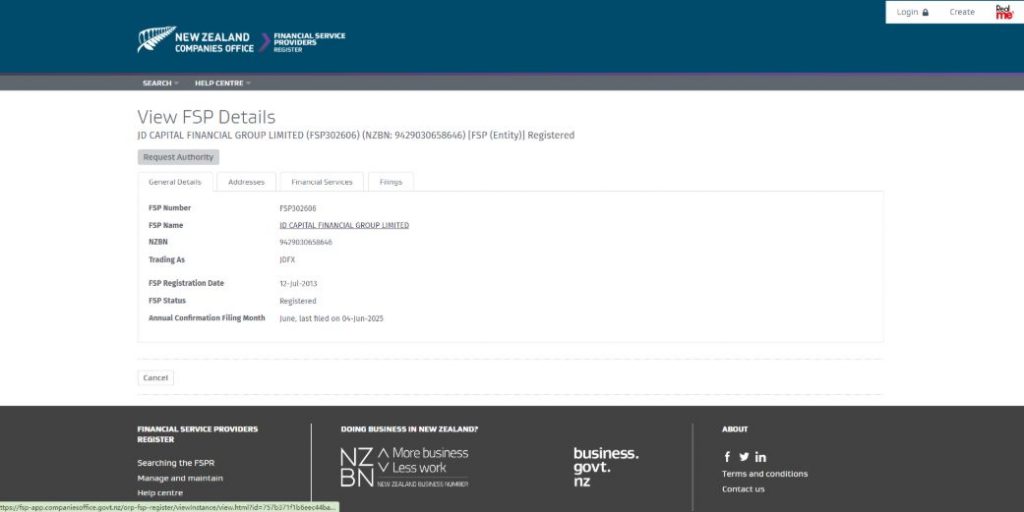

Claimed Licenses and Regulation

JDFX states registration as a New Zealand Financial Service Provider (FSP). It uses FSP number 302606 in some public records. But that registration is not equivalent to a full retail license. JDFX itself admits it only serves “wholesale” clients in New Zealand. It holds no confirmed license from strong regulators like FCA or ASIC. Thus, its regulatory standing is ambiguous and weak. This fact majorly undermines its credibility with public users.

Trading Conditions

The broker advertises three account types: Gold, Diamond, and Platinum. It mentions spreads starting from 0.0 pips and commissions per lot. Leverage can reach as high as 1:400 in some accounts. Minimum deposits for certain tiers may begin at $500. Yet many cost, margin, and withdrawal rules remain unclear. Clients cannot fully foresee hidden fees or margin policies. Such opacity often signals risks of unfair or shifting conditions.

Trading Platform and Technology

JDFX operates via the MetaTrader 4 platform for web and mobile. MT4 support enables Expert Advisors and popular tools. They offer more than 30 forex pairs, gold, silver, and indices. But performance, latency, and trade execution transparency are unverified. No public audit or demo results show real trading reliability. Thus platform claims lack external proof or validation.

Client Reviews and Feedback

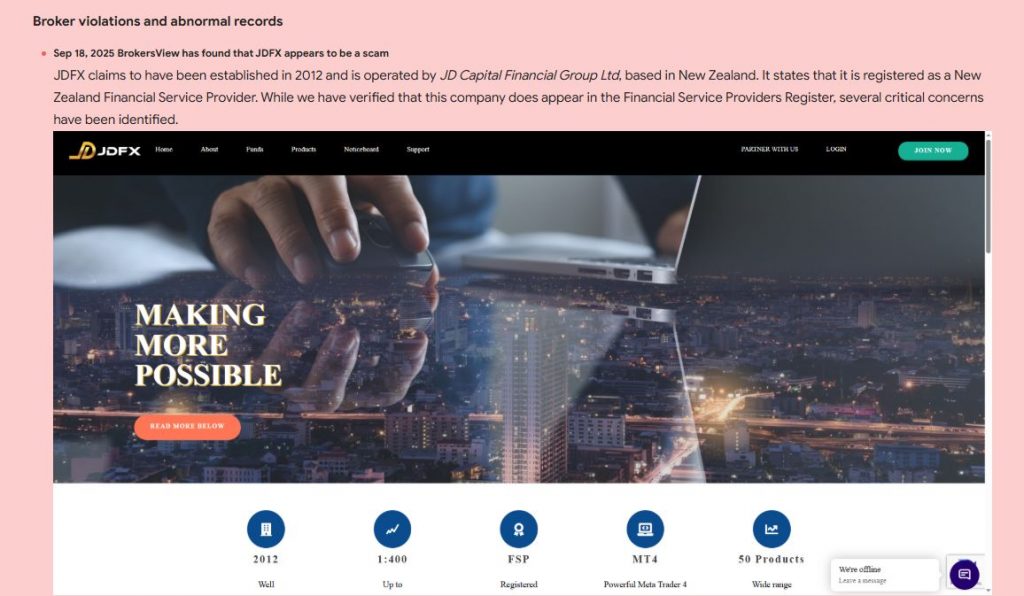

Users express serious doubts about JDFX’s honesty and service. Some reports say withdrawals were refused or accounts blocked. Others claim support communication ceased after profits appeared. A number of reviewers warn the platform may be a scam. Public broker review sites mark JDFX’s status as “SCAM.” These patterns suggest persistent problems with trust and integrity.

Potential Scam Strategies

JDFX might employ typical tactics used by risky platforms:

- Advertising ultra‑low spreads to attract new deposits.

- Allowing small withdrawals but denying larger ones later.

- Changing terms, fees, or bonuses after deposit.

- Using disclaimers about “wholesale” status to evade liability.

- Ignoring support queries or limiting access when demands rise.

Expert Opinion

JDFX raises serious alarm bells rather than assurances. Its regulatory claims remain ambiguous and weak, not solid. Trading terms omit full disclosures of costs and rules. Platform usage is standard, but no independent proof backs it. User feedback heavily highlights withdrawal and trust failures. Overall, it appears risky, possibly fraudulent, and unsuitable for most users.

Conclusion

JDFX fails core criteria for a trustworthy broker. It lacks verifiable licensing, transparent terms, and robust user reviews. The regulatory status is vague and not reassuring for retail clients. Given numerous user complaints and opaque practices, proceed with extreme caution. I strongly advise avoiding JDFX and opting for brokers with clear regulation, transparent terms, and solid reputations.