Orca Markets (orcamarkets.com) promotes itself as a modern broker. They offer trading in forex, CFDs, commodities, and indices. Their site claims to use the MetaTrader 5 platform. They advertise leverage up to 1:500 and zero account fees. They also highlight “0.0 spreads” and no minimum deposit. However, many business and ownership details are vague or hidden. These omissions already create uncertainty about legitimacy.

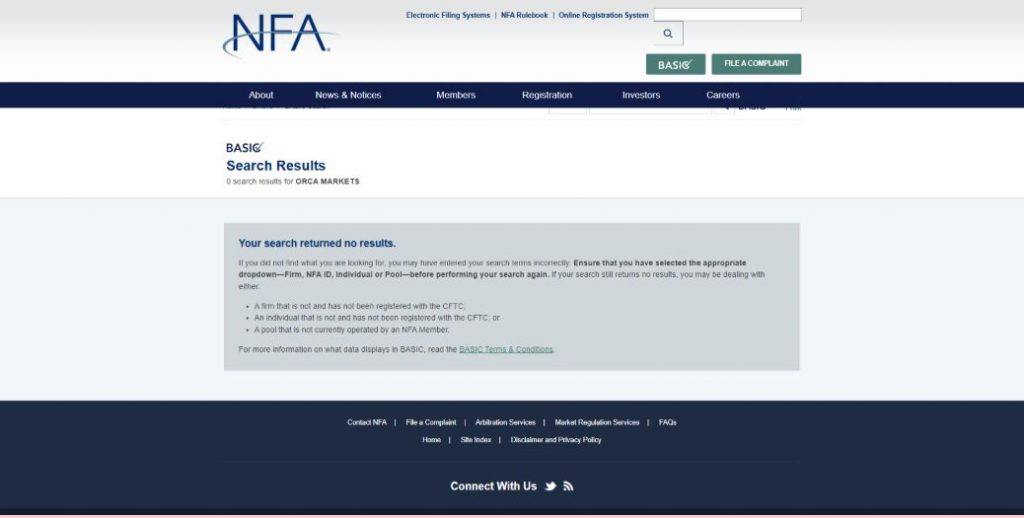

Claimed Licenses and Regulation

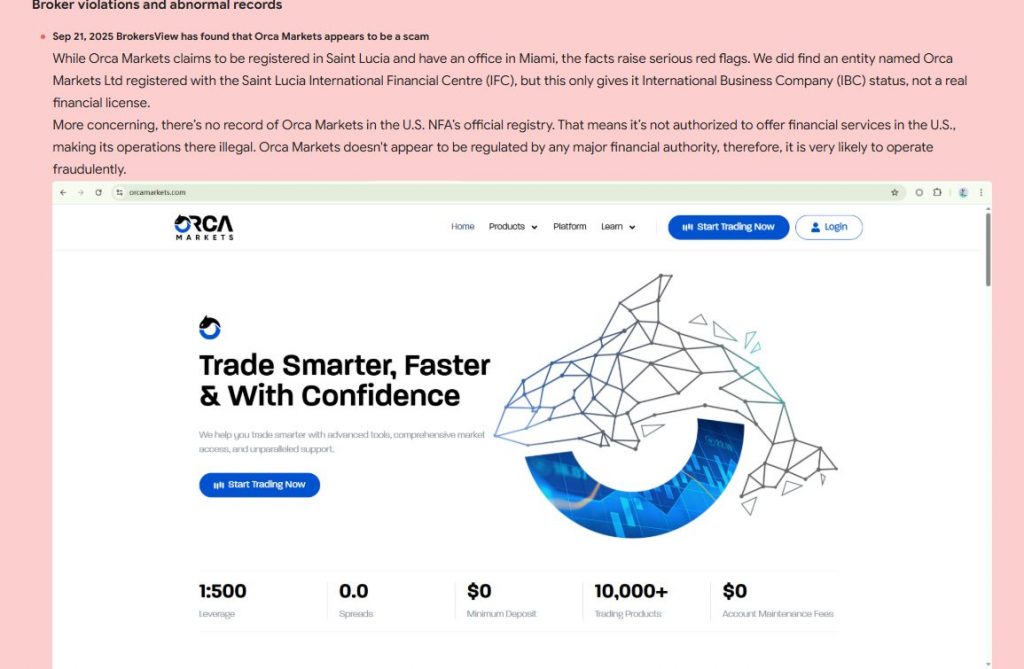

Orca Markets states it is regulated, but gives no solid proof. It claims oversight by authorities but does not list verifiable licenses. Independent sources note a lack of valid regulation. WikiFX reports “No valid regulatory information” for Orca Markets. Thus, regulatory backing appears weak or nonexistent. This lack of oversight strongly increases risk for traders.

Trading Conditions

The broker offers “floating spreads from 1.0 pip” on standard accounts. They advertise “0.0 pip spread” on pro accounts with commission. Maximum leverage of 1:500 is cited across account types. A commission of about 3.50 USD per side is mentioned for pro accounts. Yet deposit policies, withdrawal rules, and margin conditions are vague. Because of that, clients may face hidden costs or surprises.

Trading Platform and Technology

Orca Markets states they use MetaTrader 5 for web and mobile trading.

They advertise support for Expert Advisors and automated trading.

They claim to provide over 80 indicators and 21 timeframes.

However, the actual performance and reliability are not fully transparent.

Without audit or demo, users cannot test execution fairness.

Client Reviews and Feedback

On Trustpilot, Orca Markets shows many positive reviews. Users mention fast execution, tight spreads, and good support. One user praised “reasonable commissions and very low average spreads.” On the other hand, third‑party sites warn of missing regulation. Scam Detector gives Orca Markets a medium risk trust score of 64.5/100. Such mixed signals suggest possible inconsistencies in reliability.

Potential Scam Strategies

Orca Markets could use tactics common in ambiguous brokers:

- Advertising “zero spreads” to attract deposits.

- Allowing withdrawals for small amounts, but denying large ones.

- Canceling or voiding bonuses when a withdrawal is requested.

- Changing terms or fees after clients deposit money.

- Failing to respond or restricting access when problems arise.

Expert Opinion

Orca Markets exhibits multiple red flags for traders. Its regulatory claims lack verifiable proof and seem weak. Trading terms are partially disclosed but many details remain hidden. Platform claims are ambitious but lack independent validation. Positive user reviews conflict with warnings about regulation. All in all, this broker carries high risk and questionable trustworthiness.

Conclusion

Orca Markets does not meet key benchmarks for a safe broker. It lacks clear, valid licensing and full transparency over terms. While user feedback is partly positive, serious concerns persist. I advise caution and recommend avoiding significant deposits. Instead, choose brokers with verified regulation, open terms, and consistent reviews.