OTT Markets (ottmarkets.com) describes itself as a CFD and forex broker. They claim to offer trading in forex, stocks, indices, crypto, and commodities. The site emphasizes fast execution, tight spreads, and global reach. They state their platform is “designed by traders for traders.” However, essential information about ownership and company history is missing. Their domain registration and public records provide little verification. This lack of transparency starts to raise serious concerns about reliability.

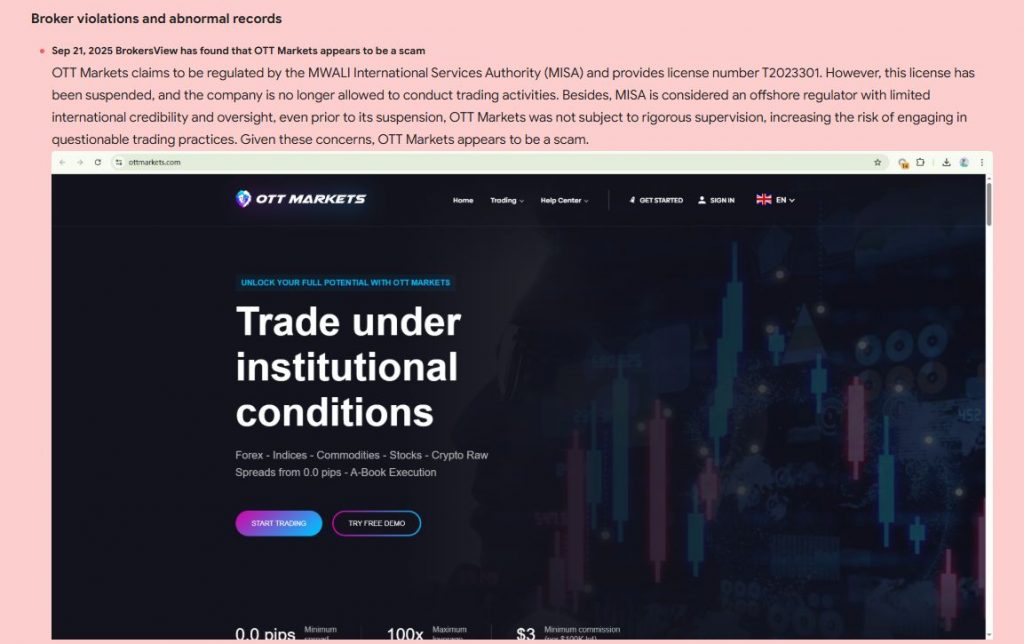

Claimed Licenses and Regulation

OTT Markets mentions regulatory oversight via MISA (Mwali regulator). However, MISA is an offshore regulator with low international credibility. There is no evidence they hold licenses from top regulators like FCA or ASIC. Independent risk assessments label their regulatory status as weak. Thus, client protections under OTT Markets appear minimal or nonexistent.

Trading Conditions

The broker advertises spread types from as low as 0.0 pips. They suggest multiple account tiers and high leverage up to 1:100. Yet, the clarity on key costs and deposit levels is lacking. Commission, fees, and full cost structures are not fully disclosed. Clients cannot reliably estimate true trading expenses in advance.

Trading Platform and Technology

OTT Markets offers the cTrader platform for web, desktop, and mobile. This gives access to order types, charts, and technical tools. They do not prominently support MetaTrader in their materials. Still, the platform’s performance and execution transparency remain opaque. Without independent audits or demo testing, trust is harder to establish.

Client Reviews and Feedback

On Trustpilot, OTT Markets receives many positive reviews from users. Comments praise speed of withdrawals, good spreads, and service. However, review platforms also contain red flags about withdrawal issues. Some complain that funds became locked or support disappeared. Independent analyses warn of missing regulation and weak oversight. These conflicting signals should prompt caution before trusting this broker.

Potential Scam Strategies

OTT Markets may use typical deceptive tactics:

- Advertising zero‑spread accounts to lure in deposits.

- Allowing small withdrawals while refusing larger ones.

- Cancelling or voiding bonuses or promotions at withdrawal.

- Imposing hidden fees or abrupt rule changes after deposit.

- Withholding customer support or blocking access when profits rise.

Expert Opinion

OTT Markets shows multiple warning signs for traders. Its regulation relies on a weak offshore authority, with no strong backup. Trading costs and account structures are not transparently disclosed. Platform claims use cTrader, but performance claims lack proof. User feedback alternates praise and serious complaints about withdrawals. Combined, these factors indicate high risk and low trustworthiness.

Conclusion

OTT Markets fails to meet many standards of a safe broker. It lacks strong regulation, clear cost disclosure, and consistent support. Given conflicting user reports and opaque practices, caution is vital. I advise against depositing significant funds with OTT Markets. Instead, choose brokers with verified licensing, full transparency, and good user track records.