General Information About Parex AM

Parex AM presents itself as an online investment broker.

The platform claims to offer trading and asset management services.

However, the website provides very limited corporate background information.

There is no clear disclosure of the legal operating entity.

Company ownership details are not published anywhere.

The broker does not clearly state its physical office location.

Domain registration data suggests a relatively recent website launch.

Nevertheless, the platform implies long-term market experience.

Such inconsistencies often raise serious trust concerns.

Some analysts already associate operations with Parex AM scam broker warnings.

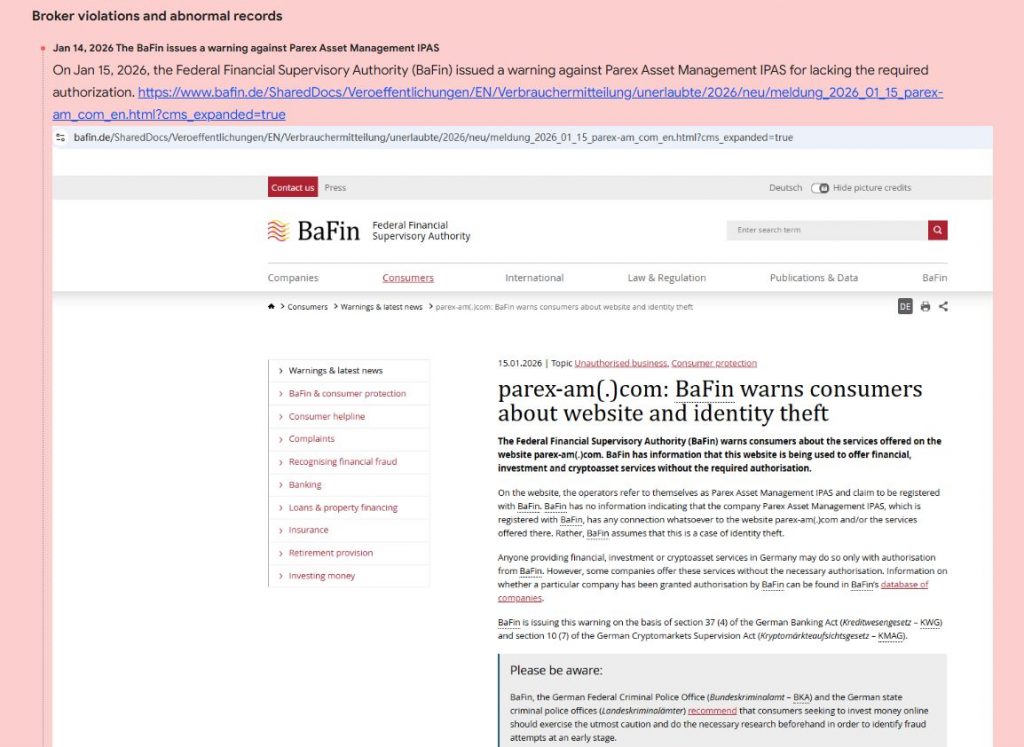

Claimed Licenses and Regulation of Parex AM scam broker

Parex AM claims to serve international clients.

However, the broker does not list any recognized financial regulator.

There is no evidence of authorization from FCA or ASIC.

CySEC regulation is also not mentioned on the website.

Moreover, official regulatory registration numbers are missing.

Operating without regulation significantly increases investor risk.

Clients may lack legal protection during disputes.

This absence of oversight represents a major warning sign.

Trading Conditions

Parex AM advertises attractive investment opportunities.

However, trading conditions remain poorly explained.

Information about spreads is not clearly disclosed.

Commission structures are also missing from the website.

Minimum deposit requirements are not transparently stated.

Leverage limits remain undefined for potential clients.

Such opacity often hides unfavorable trading terms.

Trading Platform and Technology

Parex AM promotes a proprietary online trading platform.

However, technical platform specifications are very limited.

Users cannot test platform features without registration.

Demo account availability is not clearly mentioned.

Security standards are also poorly described.

This lack of transparency reduces user confidence significantly.

Client Reviews and Feedback

Online feedback about Parex AM appears mostly negative.

Several users report withdrawal delays.

Some clients mention sudden account restrictions.

Moreover, customer support responsiveness seems weak.

Many users complain about pressure to deposit additional funds.

These complaints follow common high-risk broker patterns.

Several reviews describe experiences linked to Parex AM scam broker behavior.

Potential Scam Strategies of scam broker

High-risk brokers often promise simplified profit opportunities.

Parex AM uses marketing language suggesting easy investment success.

However, real trading always involves significant financial risk.

Withdrawal complications represent a frequent warning sign.

Hidden fees may slowly reduce account balances.

Such tactics can cause serious financial losses.

Expert Opinion

Experts advise strong caution regarding Parex AM.

The broker lacks transparency and regulatory oversight.

Trading conditions remain vague and incomplete.

Negative client feedback reinforces serious reliability concerns.

Overall risk exposure appears very high.

Conclusion

Parex AM shows multiple warning signs for potential investors.

Lack of regulation remains the most serious concern.

Moreover, unclear trading conditions increase financial risk.

Client complaints highlight withdrawal and support problems.

Based on this analysis, scam broker risks appear significant.

Investors should choose regulated brokers with proven transparency instead.