Profix Capital (profixcapital.com) positions itself as a reliable brokerage firm, offering access to trading in indices, metals, currencies, and cryptocurrencies. The company boasts innovative solutions and promises easy profits. However, a closer look reveals troubling concerns about its operations and legitimacy.

Unreliable Company Claims

Profix Capital claims to be an international brokerage and investment firm. It promotes high earnings, safe trading, and advanced financial tools. Despite these assertions, the broker is registered in Saint Vincent and the Grenadines, an offshore jurisdiction notorious for weak regulatory oversight. Moreover, it fails to provide credible evidence of having valid licenses, and its website lacks key information such as active social media links or comprehensive contact details.

Lack of Regulation and Transparency

The broker does not disclose its regulatory status or registration details clearly. While Profix Capital portrays itself as trustworthy, there is no verifiable proof of its claims. Additionally, the absence of a physical office or transparent contact options further questions the company’s legitimacy.

Trading Conditions: What’s Hidden?

Profix Capital offers account types with a minimum deposit starting at $250. It promises features like 24/7 technical support and access to multiple markets. However, essential details about spreads, commissions, or hidden costs are not disclosed. This lack of transparency prevents potential traders from fully understanding the risks involved.

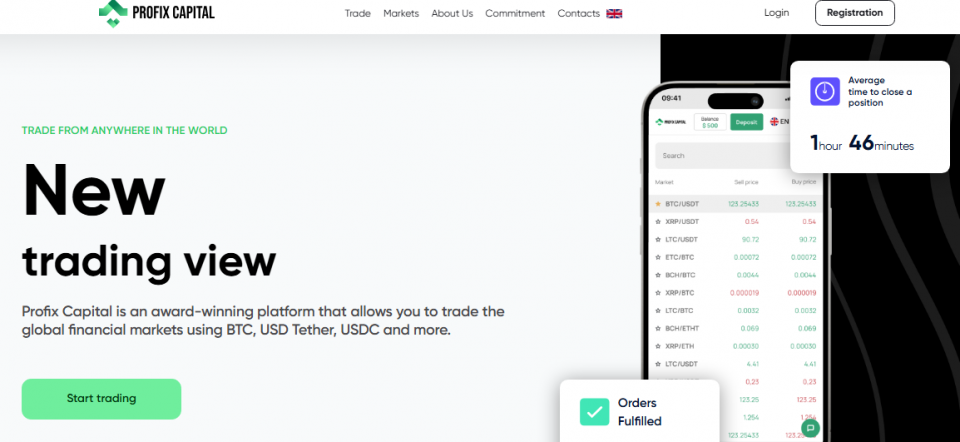

Suspicious Trading Platforms

The broker advertises its proprietary trading platform as user-friendly and innovative. However, it provides no demo account option, leaving users unable to test the platform before committing funds. This could indicate issues with reliability or functionality, creating additional risks for clients.

What Clients Are Saying

Numerous complaints from clients paint a concerning picture. Common issues include:

- Difficulty withdrawing funds.

- Poor customer service.

- Aggressive tactics to pressure clients into depositing more money.

One user expressed frustration, saying they never managed to withdraw profits despite multiple attempts. These recurring issues suggest potential unethical practices by the broker.

Scam Tactics to Watch For

Profix Capital seems to employ several common fraudulent schemes:

- Unrealistic Promises: Attracting clients with exaggerated claims of easy profits.

- Withdrawal Barriers: Making it nearly impossible for traders to access their funds.

- Aggressive Sales Pressure: Using tactics to coerce clients into increasing deposits.

These strategies are frequently used by dishonest brokers to exploit unsuspecting investors.

Expert Opinion: A High-Risk Broker

The evidence suggests that Profix Capital is not a trustworthy broker. Its lack of licensing, vague trading conditions, and a high volume of client complaints indicate significant risks. Investors should approach this company with extreme caution.

Conclusion: Avoid at All Costs

Profix Capital (profixcapital.com) poses serious financial risks to traders. It’s best to avoid this broker altogether and instead choose regulated firms with transparent operations and established reputations to protect your investments.