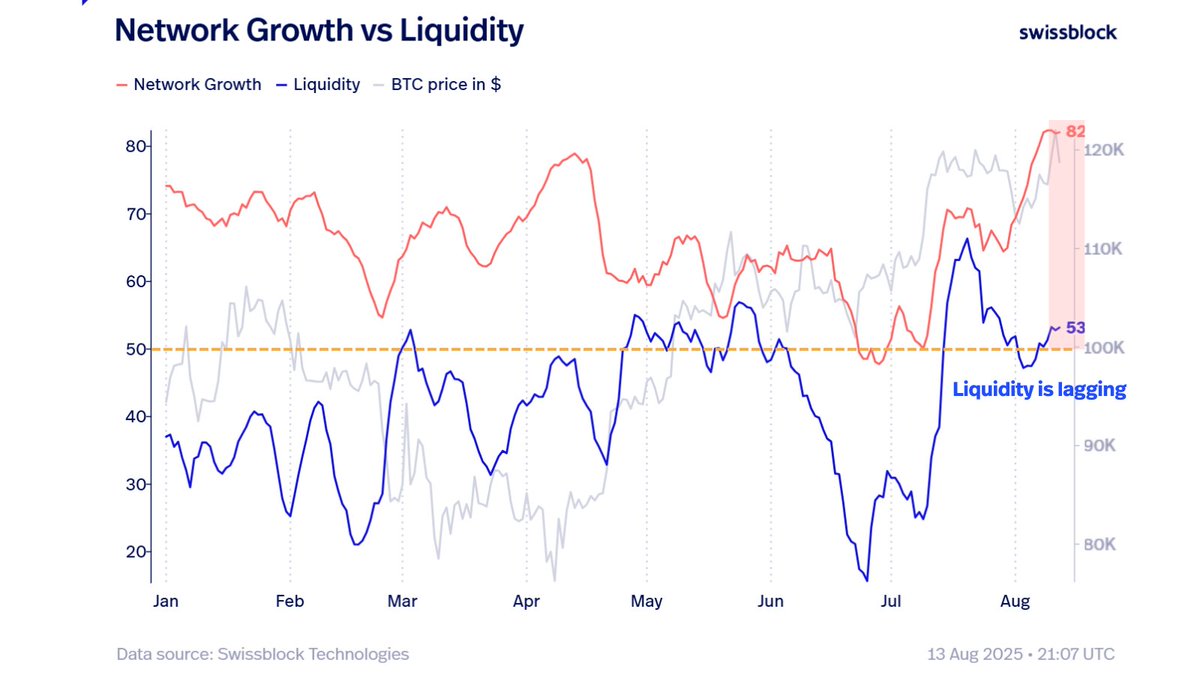

One key ingredient is missing for Bitcoin (BTC) to soar well past its all-time highs, according to crypto analytics platform Swissblock.

The analytics platform says that the on-chain liquidity metric needs to increase to trigger a convincing Bitcoin breakout.

On-chain liquidity refers to how easily and efficiently Bitcoin can be bought or sold without significantly impacting BTC’s price. A low liquidity environment suggests there are not enough buyers to absorb sell orders, triggering price declines.

“BTC’s structure is strong, but liquidity is the missing catalyst for a breakout beyond ATH (all-time high) with conviction. Meanwhile, capital rotation into ETH and alts is in full motion, setting the stage for late-cycle altcoin outperformance. The next big move will be decided by where new investor flows choose to land.”

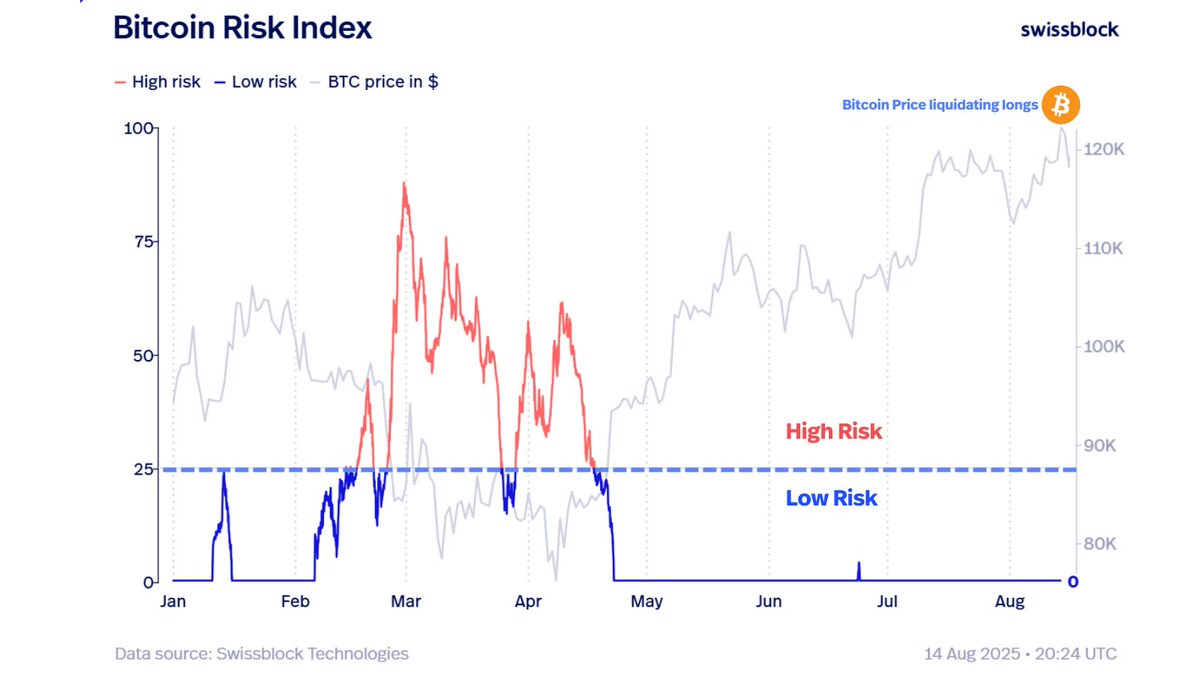

Swissblock also says that, based on the Bitcoin Risk Index, the flagship crypto asset remains in a bull market and short-term corrections are golden opportunities for investors.

The metric aims to evaluate Bitcoin’s current risk environment by aggregating various data points, including on-chain valuation and cost-basis metrics.

“As long as risk stays low, this is a buy-the-dip environment. Bitcoin punishes the over-leveraged in the short term, and downside volatility is rising – but structural risk remains contained. Low-risk regime: dips are opportunities.”

Bitcoin is trading for $117,422 at time of writing, down marginally on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney